background

In 2019, the science and technology board will be launched, and a registration system with information disclosure as the core will be implemented, and the listing standards of "allowing not yet profitable" and "sufficient technological innovation" will be implemented; The new securities law, which was implemented on January 1, clearly implemented the registration system and changed the requirement that stocks to be issued should have "sustainable profitability" to "significant amendments such as" sustainable operation ability ". This series of policies has opened a new journey in the capital market, and ushered in major historical opportunities for the development of technology innovation enterprises and equity investment funds that focus on venture capital investment in technology innovation enterprises.

The 2019 National Thousand Medical Funds Investor Conference with the theme of "Ecological Empowerment and Value Creation" was held in Suzhou High-tech Zone on January 10, 2020. Jointly discuss the professional team of Guoqian Fund, focus on medical equipment, and focus on the early stage; discover value and tap value through fund investment, accelerate high-quality industrial aggregation and ecological construction; empower enterprises and achieve enterprises through industrial ecological construction, and accelerate fund investment Three-wheel drive "Guo Qian" mode.

Opening speech

Dong Min, general manager of Su Gaoxin Venture Capital, addressed the conference and expressed that as one of the investors of Guoqian Medical Fund, he was gratified for the outstanding achievements of Guoqian Medical Fund and congratulated Guoqian Medical Fund for its better development in the future. Mr. Dong also briefly introduced the basic situation of Su Gaoxin Venture Capital and looked forward to more extensive and in-depth cooperation with the enterprises present.

Keynote Speech

Topic of speech: The recruitment, investment, management, and withdrawal of Guoqian Venture Capital

Speaker: Dr. Zhang Xu, Chairman of Guoqian Venture Capital Management (Suzhou) Co., Ltd.

In his speech, Dr. Zhang Xu emphasized that future private equity investment must be specialized in subdivided fields. And put forward five points of investment logic and philosophy: technological innovation breakthrough; rigid market demand; there is a certain size of market space and room for expansion; low enough valuation; promote the rapid development of invested companies through industrial ecological construction.

In addition to having a shareholder-level expert team to discover and mine early projects, the core competitiveness of Guoqian Fund is more important to build value and create value through industrial ecology and empowerment, help start-ups grow and succeed, and accelerate fund exit and return Investors.

Keynote speech: Capital Market Opportunities and Choices of Science and Technology Board and Pharmaceutical and Medical Enterprises

Speaker: Wei Dejun, Managing Director of CICC Investment

In his speech, Mr. Wei shared some of his views on the biopharmaceutical industry, including medical devices, and pointed out that with the improvement of the domestic innovation atmosphere, small and medium-sized medical device companies have increased their R & D investment after the initial capital accumulation. Regardless of the improvement in the number and quality of approvals, the trend of import substitution has become irresistible, and high-end medical devices will occupy the main market share in the future.

The newly launched Science and Technology Board focuses on supporting high-tech industries including biomedicine and strategic emerging industries, and supports the listing and financing of technological innovation companies with key core technologies and high market recognition. The Science and Technology Board supports the listing of non-profitable biopharmaceutical companies, providing a wider financing channel for biopharmaceutical companies including medical devices that have a long industrialization cycle and require continuous capital investment. The exit cycle of investment funds.

Topic of Speech: Development Trends and Future Prospects of the Medical Device Industry

Speaker: Dr. Miao Chen, Partner of Huatai Zijin

Dr. Chen Miao mentioned two major challenges facing investment companies:

● From the industry: the severe medical insurance payment situation, including policies such as volume purchases and DRG payments, aimed at controlling the growth of medical expenses; subtle Sino-US relations affect the process of internationalization; and the continuous strengthening of industry supervision

● From the aspect of investment and financing: the new rules of asset management and economic situation have led to a significant decline in investment; the high valuation, high risk, and insufficient preparation for the medical and health industry; the restructuring of the valuation system; Early transfers are transferred from sponsors to underwriters.

At the same time, Dr. Chen also proposed countermeasures: focus on professional fields, cultivate differentiated competitiveness, and build an industrial ecosystem.

Topic of speech: Large medical device technology, market and investment opportunities

Speaker: Dr. Zou Xueming, co-founder of Guoqian, academician of American Academy of Medical and Biological Engineering, chairman of Aotai Medical

Dr. Zou Xueming, as the creator of the 1.5T large-caliber superconducting magnet and superconducting nuclear magnetic resonance machine with independent intellectual property rights in China, conducted an in-depth analysis of the current domestic large medical device market status and investment opportunities The R & D capability of the whole machine is weak, but the import substitution of some of its core components has good development prospects and investment opportunities, such as CT bulbs, detectors, and generators.

Lecture topic: The layout of Guoqian Venture Capital in China's medical device industry Speaker: Dr. Hao Chen, Partner of Guoqian Venture Capital Investment

At present, medical device companies that have or are planning to log in to the capital market are mainly concentrated in three major subdivisions: in vitro diagnostic reagents, high-value consumables and medical imaging. The projects invested by the State Foundation in the early stage are also mainly concentrated in in vitro diagnostic reagents and high-value consumables. Two subdivision areas. Dr. Chen Hao emphasized that Guo Qian is concerned about the layout of the medical device platform industry in the construction of industrial ecology. Currently, he has invested in enterprise platforms covering artificial organ platforms, medical AI platforms, immunodiagnostics and immune raw materials platforms, molecular diagnostic platforms, mass spectrometry detection applications and raw material platforms. , Biomaterial platform, etc. The high-density aggregation of these platform enterprises will inevitably produce scale effects, specialization effects, collective effects, and external spillover effects of innovative elements such as talents, information, technology, and knowledge. The superposition of these effects will inevitably help the growth of enterprises.

Topic of the speech: Our Road to Creating "Heart" Speaker: Dr. Xu Boling, Founder and Executive Officer of Xinqing Medical

Founded in 2017, Xinqing Medical is led by Dr. Xu Boling, a young expert of the "Thousand Talents Program", integrating R & D resources at home and abroad. Dr. Xu Boling won the Nose International Scholar Award from the American Artificial Organs Association, one of the three largest artificial organs associations in the world.

Dr. Xu shared her entrepreneurial psychological history and entrepreneurial concept with you in her speech. She said emotionally, my wish is that the product will come out as soon as possible to save patients, because Guo Qian, this desire is getting closer and closer. My second wish is to mass-produce the product and save more patients. Based on core platform technologies such as mechatronics, magnetic levitation, and computational fluid dynamics, Xinqing Medical is currently committed to creating the world's second and only in vitro magnetic levitation artificial heart in China. In the future, platform solutions in the field of artificial organs will be developed to serve patients worldwide. At present, Xinqing has taken the lead in completing pre-clinical large animal experiments, and the products are the first to be submitted for type inspection, aiming to produce clinically-needed products that solve the problem of import substitution.

Topic: The value of high-availability tumor molecular diagnostic technology and Angkai ’s entrepreneurial ideas and practices

Speaker: Dr. Wang Qianghu, Chairman of Angkai Life

Dr. Wang Qianghu, postdoctoral fellow, professor and doctoral supervisor at the University of Texas Anderson Cancer Center. In his speech, Wang Bo shared with everyone that the "DNA Methylation Hypersensitivity Joint Detection Technology (MeMore)" developed by his team led by Ang Kai was developed for the detection of the DNA methylation status of trace blood free DNA, which can realize multiple tumor markers Highly synchronous gene detection breaks through the current technical bottleneck of DNA methylation detection. Angkai Life focuses on the development and application of early tumor liquid detection technology. While greatly improving the early screening of tumors, it disruptively reduces the cost of detection, effectively breaks through the bottleneck of DNA methylation detection technology, and reconstructs clinical application scenarios. Pan cancer early screening entered the field of general inspection.

Round Table Forum

Moderator: Dr. Zhang Xu

Thousand Talents Plan Expert

Co-founder / Chairman of Guoqian Medical Technology (Suzhou) Co., Ltd.

Forum guests (in no particular order):

Dr. Xueming Zou

Thousand Talents Plan Expert

Co-founder of Guoqian Medical Technology (Suzhou) Co., Ltd.

Fellow of the American Academy of Medicine and Bioengineering

Chairman of Aotai Medical System Co., Ltd.

Dr. Zhao Yong

Thousand Talents Plan Expert

Co-founder of Guoqian Medical Technology (Suzhou) Co., Ltd.

Chairman of Jiangsu Beitaifu Medical Technology Co., Ltd.

Cao Jin

Co-founder of Guoqian Medical Technology (Suzhou) Co., Ltd.

"Thousand Talents Program" expert entrepreneurship mentor

Dr. Donghui Ma

Chairman of Suzhou Dianma Biological Technology Co., Ltd.

Dr. Wang Qianghu

Chairman of Angkai Life Technology (Suzhou) Co., Ltd.

The guests of the forum had a lively discussion on the theme of "how the construction of industrial ecology is conducive to the growth of enterprises and the accelerated exit". Participants at the meeting agreed that in addition to the investment of funds, the establishment of a good industrial ecology, from the large industrial ecology of environmental factors such as the government, industrial chain, capital, talents, and market in the enterprise gathering area, to individual companies The micro-ecology of registration, research and development, type inspection, clinical, certification, production, sales, etc. required in the development process is more important for these high-tech-driven medical device companies to start their businesses, and it is really empowering startups. , To obtain income for fund investors.

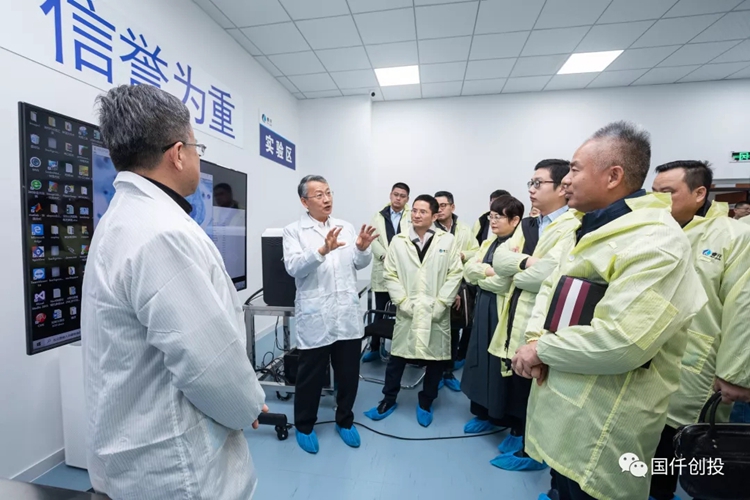

Tour Highlights

Visit Ruiqian

Background information: Ruiqian Technology was co-founded by Dr. Wu Xiangchen and three thousand-person plan experts in July 2017. The company builds on a platform of fully automatic 3D high-speed microscopy system and artificial intelligence (AI) technology with independent intellectual property rights. The full range of digital solutions of the pathology department, the product cuts into the huge cervical cancer screening market, compared with the current clinical manual operation, the rate is increased by 5 times, and the efficiency is increased by 100 times, helping to solve the global problem of shortage of clinical pathologists. The product has established a domestic quality sample library, has completed type inspection, and will be approved for listing soon.

Visit Xinqing